Giles Specialist Cars

Specialist supplier of Sports, Performance and Prestige vehicles

The world of Finance can be a minefield to many discerning car buyers which is why we only deal with an independant brokerage who have access to the entire market. We are an approved Independent Appointed Representative for Meridian Finance LTD and have been dealing with them for many years. They are our trusted suppliers of Finance who will go the extra mile to ensure the product is right for you. Follow the link at the bottom of the page to apply now or speak to someone regarding your next purchase.

Car Finance Explained

If you’re not paying with cash, you’ll be using car finance or credit to buy your car. If you’re using credit, you’ll get the best deals if you have a good credit score.

Remember, just because your credit score is good and you’re allowed to borrow a larger amount, it doesn’t mean you’ll be able to afford it. You need to work out all your outgoings and be confident that you can make all the repayments for the full term of the credit deal.

If you get behind on your car payments, talk to your finance company or lender as soon as possible. You might be able to return the car or pay off the loan early.

Please take time to read the information below on the different types of Finance products available and decide which suits you best.

Using a personal loan to buy a car: how it works

A personal loan from a bank or building society lets you spread the cost of buying a car over one to seven years.

If you don’t have enough cash or savings to buy a car, personal loans are usually the cheapest way to borrow money over the long term.

The monthly repayments can be higher than other options, but you own the car from the start of your loan and the total amount you pay should work out less than most other methods.

If your credit score isn’t good you might find it difficult to get a loan.

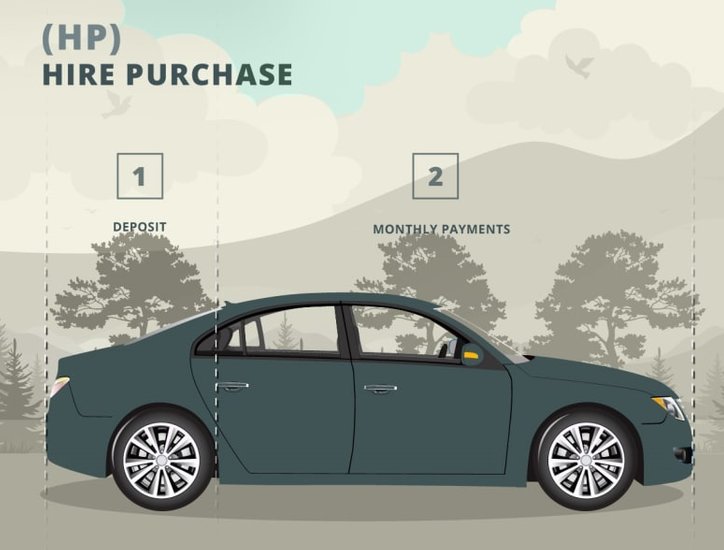

Hire purchase

This is a simple type of car finance. You usually pay a deposit of around 10%, then you make fixed monthly payments over an agreed period.

Here’s what you need to know:

- The car isn’t yours until after the final payment, unlike with a personal loan. This means the loan is secured against the car, so if you miss payments, you could lose the car.

- Hire purchase agreements are set up by the car dealer, and brokers also offer the service.

- Rates are best for new cars, so check what you’ll be paying if you’re buying a used car.

- You have certain consumer rights with hire purchase agreements.

- Once you’ve paid half the cost of the car, you might be able to return it and not have to make any more payments – check your contract to see if this applies to you.

- Once you’ve paid a third of the total amount you owe, your lender can’t repossess your vehicle without a court order.

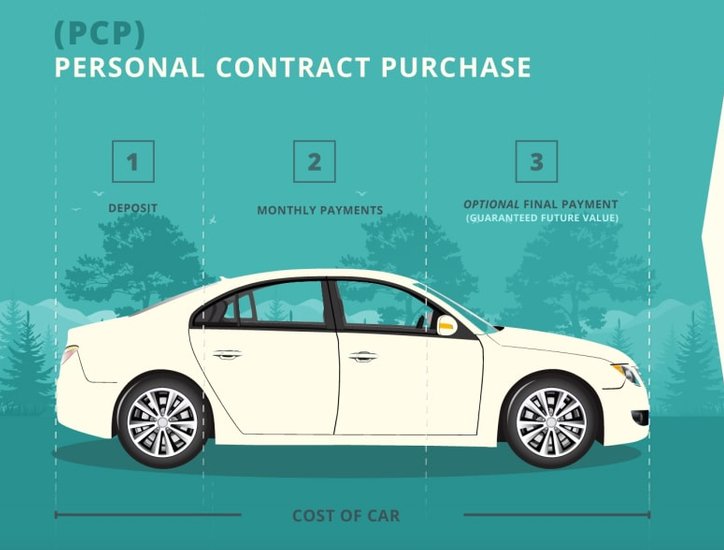

Personal Contract Purchase (PCP): how it works

A Personal Contract Purchase (PCP) is a more complicated way to pay for a car. It’s like hire purchase, allowing you to use the car until the contract ends.

At the end of the contract, you can either:

- Return the car.

- Pay the resale value and keep it.

- Use the resale value towards buying a new car.

You need to be aware of how a PCP works to make sure it’s right for you.

Here are the steps to getting a PCP deal:

- You’ll need to pass a credit check before the PCP is set up. However, your ability to make the monthly repayment will not be checked.

- Before you sign up for a PCP deal, it’s really important to make sure you have worked out that you can really afford to meet all payments over the whole term of the contract, which could last up to four years.

- You’ll need to pay a deposit, usually 10% of the value of the vehicle.

- Use the car and make your payments for the duration of the contract.

- Make sure you stay within your mileage restriction. There will be charges if you go over your limit.

If you want to keep the car, you’ll need to make a final payment, often called a balloon payment. This is based on what the dealer thinks the car is worth now – its Guaranteed Future Value (GFV) and can range from a few hundred to a few thousand pounds. It will be a larger payment than your monthly payment. If you haven’t got this money saved, you may have to take out another loan to pay it off.

If you’re not going to keep the car, you can hand it back without any further payments.

Alternatively, you can offer to pay off the GFV and put down another deposit for a new car.

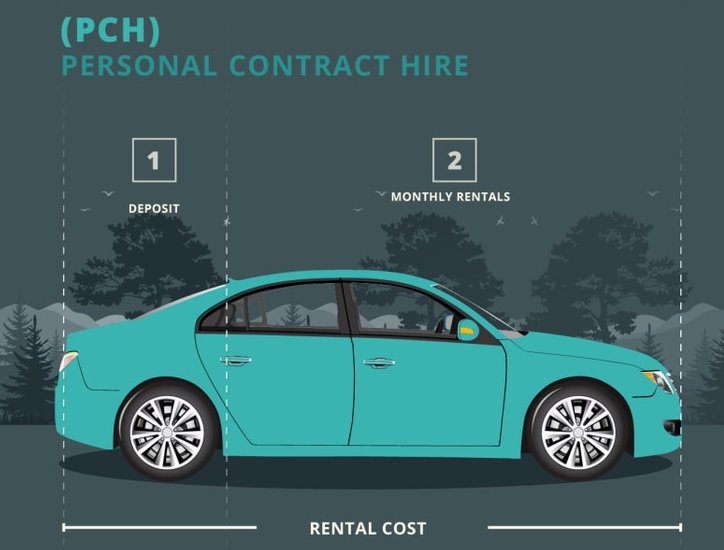

Personal Contract Hire (PCH): how it works

A personal contract hire (PCH) plan is a form of car leasing where you never own the car.

If you’re not planning to buy the car at the end of a PCP, a PCH might be a cheaper option.

Here’s how PCH works:

- You will need to pass a credit check and pay a few months’ lease upfront, typically three months’. Although you may pass the credit check, companies don’t check whether you can afford the monthly payments. It’s up to you to make sure you have worked out that you can pay what you’re agreeing to. It’s really important that you’ve thought about all your outgoings before you sign any deal and that you’re confident you’ll be able to meet repayments for the full length of the contract.

- Use the car, sticking to your mileage agreement to avoid extra charges.

- With a PCH, costs such as servicing and vehicle excise duty (car tax) are included, so you only need to pay for fuel.

-Keep the car in good condition. Any damage not allowed in your terms and conditions might mean you get extra charges.

- Return the car at the end of the agreement.

Here are the important points to know about PCPs:

- Always check your contract and terms and conditions to make sure you understand any fees and what happens if your situation changes and you need to alter your agreement.

- Make sure you know how much you’re paying back – often you’ll pay more with a PCP than with other types of car finance.

- You’ll usually be charged for exceeding your agreed mileage.

- Excessive wear and tear and damage, such as scratches, can mean you’ll receive additional charges.

To end the deal early or cancel it, you must have paid half the value of the vehicle. If you haven’t, you’ll need to pay the difference before you can get out of the contract. The car will need to be in good condition too, or you might be charged for repair costs.

If you plan to take your car abroad, check your PCP contract as some companies will impose a limit on the number of days your car can be out of the country.

Here are the important things to know about a PCH:

- Always check your contract and terms and conditions to make sure you understand any fees and what happens if your situation changes and you need to alter your agreement.

- If you go over the mileage in your contract, you’ll usually be charged extra fees.

- You never own the car and have to return it at the end of the contract term.

- If you want to end the contract early, you usually have to pay some charges. Check your terms and conditions before you sign up so you’re prepared if you need to get out of the contract.

- When you return the car, it must be in good condition. Normal wear and tear is usually allowed, but this depends on your agreement. Any damage that isn’t covered might mean you have to pay extra charges.